|

Blog Feeds

Anti-Empire

The SakerA bird's eye view of the vineyard

Lockdown Skeptics

Voltaire NetworkVoltaire, international edition

|

The Economy After the Covid Lockdown national |

economics and finance |

feature national |

economics and finance |

feature

Monday April 27, 2020 13:35 Monday April 27, 2020 13:35 by 1 of indy by 1 of indy

Pre-emptive strike on the global economy

Never before in the history of the world has there been such a massive and widespread shutdown of the economy for as long as for this Covid-19 scare. As of today April 21st it has been more or less shutdown for a month and the politicians instead of doing their usual and saying we will be out of this soon are saying we need to continue it indefinitely and even when the lockdown is lifted, it will only be gradual return to normality. Clearly everyone is worried and a lot depends on how long this lockdown continues for. The question is not whether the economy both here in Ireland and globally will be damaged but more by how much. This is an important question because real lives depend on what happens in it Here we attempt to assess where we are, what has happened and what logic dictates are some of the possible outcomes. Britain’s 77th Psy Ops Brigade Has Been Activated to Counter Coronavirus “Disinformation” The British military waging information war on their own population https://www.anti-empire.com/britains-77th-psy-ops-brigade-has-been-activated-to-counter-coronavirus-disinformation/

Related Links: In London alone 600 people a week more are now dying from heart attack because they were afraid to go to hospital If Sweden Succeeds, Lockdowns Will All Have Been for Nothing | In Frenzy to Empty Hospitals for Doomsday Model Predictions UK and NY Wreaked Mass Death on Care Homes | American Billionaires Have Gotten $280 Billion Richer Since the Covid Hysteria Pandemic | Coronavirus – The Aftermath. A Coming Mega-Depression…By Peter Koenig (ex World Bank)

The LockdownThe lockdown, we are told is of course due to the Covid virus and to "flatten the curve". The curve, according to models using very unreliable data (rubbish in, rubbish out) and very questionable figures on mortality provided by the World Health Organisation (WHO) (-a corrupt organisation captured by the pharmaceutical industry and exposed in the documentary Trust WHO , -suggested a high number of deaths because of the projected infection and mortality rate and the prediction it would overwhelm the capacity of the health systems in each country. The WHO consistently downplayed any suggestion more people had the virus (and were fine) and the only narrative they pushed is that we should keep our economies in lockdown until a vaccine was found which it is promoting very heavily and pushing to make mandatory. This will no doubt make a fortune for the pharma industry controlling the strings of those making the decisions at the WHO. These disease models rely on certain assumptions and inputs. If for one of these inputs you enter a given death toll and another figure specifying how many people have been exposed to the virus, it then predicts how many will die if everyone is exposed. If far more people have been exposed than acknowledged then your input is wrong. If the real figure was used, the predicted death would be far far lower. This is why in Sweden where they have almost achieved herd immunity without a lockdown, they are not all dead. However the WHO have knowingly used incorrect values because this way the models (wrongly) predict a huge spike in cases that need to be flattened from the dizzying heights projected and this allows them to justify the lockdown. Governments have followed their narrative via their chief medical officers taking instruction from the WHO. This fraud has worked because unwittingly many people including doctors do not realize how utterly corrupt the WHO are, they follow their advice. Their agenda will be discussed later. The WHO screamed at Sweden via the media to lockdown. Who the heck are the WHO to be trying to order a sovereign state like Sweden around? Thankfully they didn't follow their advice and provided an example that proves the nonesense followed elsewhere. So far in the case of Ireland Covid-19 has led to a total of 730 deaths (Apr 21st) which is less than the typical 1,100 deaths due to flu per year in Ireland. In the UK a total of 17,337 deaths are recorded which is also less than the number of deaths due to flu in the UK which can be up to 28,000. Similar statistics bear out for other countries. Incidentally because flu deaths were so low last year everywhere and each year the flu sweeps up all the old and vulnerable, it meant this year the Covid virus had a potential population that it could easily kill and the numbers bear this out especially the median age of death which proves this. The lockdown in the case of Ireland has shutdown first and foremost all the pubs. They are now closed for 28 days. If the pubs closed for 2 days previously, there was a national outcry and hoarding of drink. Practically all the restaurants, cafes, hotels, guest houses, bed & breakfasts, Air BnBs and furniture, clothing, book, accessories, flower, jewellery, bicycle and charity shops; hardwares, DIY stores, barbers and hairdressers, electrical retail, cinemas, threatres, concerts, schools, universities & colleges, libraries, swimming pools, gyms, sports facilities and grounds, building industry, real estate, public transport is empty except to key workers, parts of manufacturing, offices, many trades people out of work too and probably a lot more niche areas normally invisible to us. Most visible is that air travel is for all intents and purposes shutdown. A quick glance at Flight-Radar-24 website shows that. For instance Ryanair has over 300 aircraft and almost the entire fleet is grounded. How did O' Leary agree to this? Likewise Aer Lingus, British Airways, EasyJet, Lufthansa and a long list of other airlines are grounded. Even for 9/11 this was only for 2 or 3 days. This is going on for a month now and instead of the Taoiseach or the Prime Minister in the case of the other countries saying we hope to end this soon, instead they are saying, this could go on for months and even then we might not allow groups bigger than 10. Well if a typical airplane can hold 200 to 300 people, that looks like they will either still be grounded or working in highly restricted form. This will therefore affect hotels and the entire tourism industry. Because when we are all stung with the taxes to pay for this, will people be able to afford to travel? Even for the businesses still open, this whole caper is highly disruptive and while tens of thousands are working from home in Ireland -millions worldwide, it is probably not effective for many firms, long term. For the social life the impact is equally greater if not bigger but we will leave that aside for now as we are discussing the economy even though the medical argument of saving lives is countered balanced by the undoubted increases in depression and suicides and the number of extra deaths for all the people who normally visit hospital but are too afraid to now. Figures for Scotland from the start of April already show an additional 500 deaths after subtracting out the Covid ones and these are the people who probably got heart attacks or strokes but never went to hospital as they normally would. So as you can see it is unprecedented and without doubt very costly in all sorts of ways. The hard bit to take in, is that this scenario is replicated right across the entire EU and much of the USA and it is estimated 2 to 3 billion people are in lockdown. The number of closures is just mind boggling. In much of the EU national governments have stepped in to provide special emergency payments to the millions unemployed. As of the start of April -nearly 3 weeks ago, over 200,000 people were unemployed and then within a week of that up to 500,000 and are in receipt of the Covid payment of €350 per week. This means it is costing the government 350 x 500k = 175 million a week which we can safely round up to 200 million since this figure in no way accounts for numerous others costs and doesn't even begin to take account of loss revenue to the state in the form of income tax from these people. By this stage the 500k unemployed is likely higher. The cost then so far is probably several billion. On April 1st KBC Bank (ref 3) put out an estimated cost of €30 billion (Ref 3). It was not clear when they thought the lockdown would lift in their calculation but it would be safe to assume at that point they were thinking by May. It ought to be noted €30 billion is less than half the bailout to the banks after 2008. The only remaining questions regarding the lockdown are how long it will last and will it be lifted in one go or gradually? The people calling the shots in the WHO advising the chief medical officer in each country who in turn advises the national leadership in each country, appear to have gained a incredible level of authority and power over sovereign states and it is rather odd and surprising that basically the best part of the entire world economy has ground to a halt based on their dictates. Extremely odd in fact. How can a bunch of stuffy bureaucrats have so much power? Maybe even more strange is that our apparently free and purveyors of 'truth' media haven't asked these questions. The Economy Before Covid-19Up to early March, the economy in Ireland at least seemed to be doing alright although there were plenty of problems. Fine Gael (FG) through its housing policies driven by right wing ideology had led to 10,000 people homeless of which one third are children. Odd the way they apparently care about people now in this crisis but clearly don't about the homeless. The housing sector had witnessed a rapid increase in vulture fund (i.e. billionaires savings) owned properties and was distorting the housing market with the effect of locking out increasing numbers of the working population from ever buying a house or apartment and pushing them into a life of high rent, screwed by the same people. So other than FG selling all the assets acquired by NAMA and paid for by the tax-payers to vulture funds for pennies on the Euro (-93% of all NAMA property sold at huge discount to them), the top 20% to 30% were doing alright and there was a slight trickle to the bottom. Given the long recession after 2008, it was still welcome. As of the beginning of March 2020 the unemployed rate was 5.4% down from 7.4% in 2017 and the number employed stood at 2.3 million. The economy in Ireland in terms of GDP is dominated by the multi-nationals that are here primarily for the low to non-existent corporate tax rates, the reliable electricity which tends to be unrecognized but vital in many industries and for the fact the Irish workforce speaks English, is in the EU and reasonably educated. There is little indigenous Irish industry. Irish capitalists tend to invest in property rather than put money into Irish industry. The model has been to attract foreign investment rather than invest in Irish industry and hence explains why successive governments always dance to their tune. Basically Ireland pimps out it's workforce. From Central Statistics Office (CSO) records, in 2017 there were about 279,892 Irish owned businesses in Ireland and 3,352 foreign owned ones most of which were multi-nationals. Figures released for 2019 and reported by the IDA say that multi-nationals account for 229,000 jobs or about 10% of the total. They spend €11.7 billion on payroll. The key areas are in biotech, pharmaceuticals and high tech sector chiefly in software and social media. Their turnover is out of proportion to their size and dominates the economy. In terms of overall employment the biggest sectors are industry, wholesale & retail trade and health & social work. There are many small enterprises serving the multinationals and it has been said that for every one person employed in them, there could be several more employed in other areas downstream of where people spend their wages. However as a result of the crash 2008, there was a huge debt overhang in the economy and for the lower half of the working population their pay and conditions have not really recovered when inflation is taken into account. Indeed inflation can be misleading, because if you are spending half your income on rent or mortgage and the inflation statistic doesn't capture that, then it does not give the full picture. What matters once you can eat is the roof over your head. It doesn't matter whether all the trinkets of society are getting cheaper if the cost of the roof over your head is taking up most of your salary. What was laid bare after 2008 for all to see was that the bankers, big investors and developers ultimately got bailed out no matter what spin is put on it and the top 1% and 10% got richer in the years since. The rest of us had to pay for it through higher taxes, direct and indirect, plundering of the national pension fund and stagnant wages for many. In the recent election, late in the day the issue of the pension being only paid out at age 67 (instead of 65) and soon to be 68 years had come to public attention. Two and even three years when you don't get the pension is the same as being robbed of that amount. So overall the Irish economy could be summed up as doing alright and it was going in the right direction. The International Economy Before Covid-19The economy internationally being a bigger beast is harder to cover in any detail suffice to say that at least it wasn't in recession despite the bit of the trade war between the US and China and Europe pre-occupied with BREXIT. Share prices in Wall Street were at all times high. Much of this was down to the big corporations spending billions on stock buy back schemes whose sole purpose is to keep the share price high and make money for those with lots of stock options and shares, primarily the owners and CEOs. One large elephant has stood over the world economy since 2008 and that has been the constant money printing known as quantitative easing not just by the US (privately owned despite what the name suggests) Federal Reserve, as well as the EU Central Bank, Bank of Japan and others. The point being no matter how many pronouncements we heard over the years of how well the economy was doing, in reality in still needed a constant injection of cash to stay alive. Depending on who you listen to and what you read, the total world debt varies from tens of trillions to quadrillions if you include derivatives. Even mainstream websites (ref 2) put US debt at $24 trillion and the UK at £8 trillion. When you delve into the funny world of financial derivatives and all the other tricks you begin to realize that the size of the financial economy (i.e. paper) compared to the real economy is far bigger. Its near impossible to get accurate statistics probably because there are none. The financial economy is more an abstraction than anything. What it attempts to do is to put a claim on the real economy. So if you hold a million shares of some financial instrument this implies ultimately if you wanted to cash in; you could and buy something real. But if that universe of money is bigger than the real one, then when the music stops and everyone wants to cash in, you will find there are multiple overlapping claims on the same bit of physical real world wealth. Thus the global economy was tottering along but the financial side of it had becoming increasing absurd and the whole core of it was basically unstable. It could hardly even be called a capitalist system and was more like a global debt system with lots of insider trading, rigging of the market and all sorts of interventions like money printing, buying back debt and bailing out of the too big to fail and so on. Somehow most people with jobs, savings and pensions were probably dimly aware of the chaotic forces within it, but hoped it would stay together -since the market always recovers -and thereby provide them with a means of income. The Impact of Covid.Well its going to be massive. The game is to speculate how massive assuming we are released from this medical police state this side of Christmas. As the news broke back in early March, Peter Schiff stock broker and financial commentator had this to say about the economy:

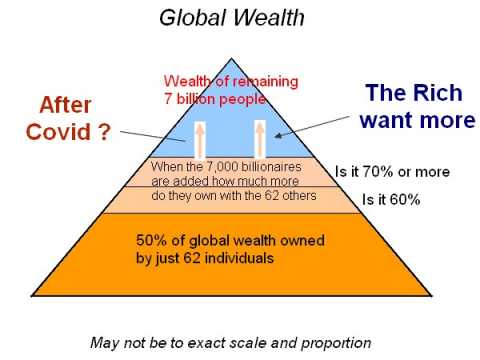

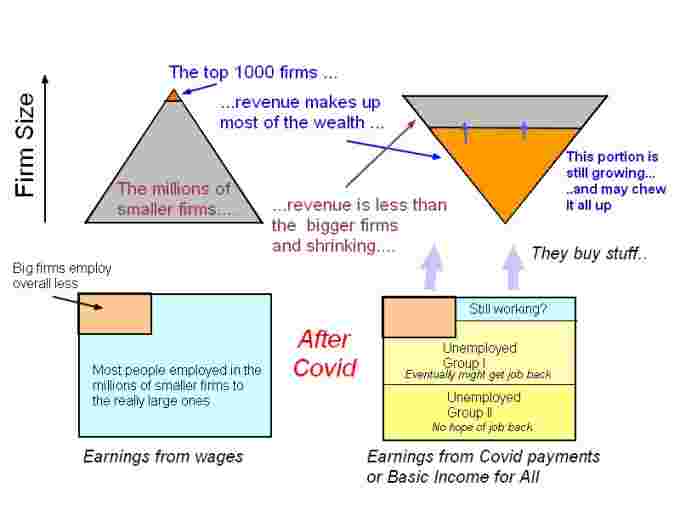

This was in March. One would assume his worst case scenario then was a lockdown for at most a month or so because that's what people were predicting then and China had just come through it's own lockdown of that about a months duration. Before going on a speculative tour it is worth putting some basic numbers on it and lets just stick to the Irish economy. The impact is hard to predict because the effect is so global and has hit practically every form of economic activity all at once. What we are witnessing has never been seen before and it will set in train all sorts of forces and dynamics. What we do know is cash flow is going to be the big problem. Every business lives or dies by it. You depend on those you sell to, to give you the cash so that you can pay your suppliers. Often there can be anything from 30 to 90 days before receiving payments. For example, if you are selling goods wholesale which ultimately get sold on in shops, it can take a month or two before you are paid so that you can pay the supplier and you could have many. The supplier in turn is in their own chain of relationships with others. If even a few firms go bust then it can put the others into huge financial stress and it only takes one more knock somewhere else in the chain to bring you down. It will be like dominos falling. Hence the need for banks to extend loans to small business at very favourable rates. A public bank would be in a position to do this, but the private banks just see an opportunity to screw people over and sell on their assets when they fail to collect their money since they will be under pressure too. If the bailout mainly goes to the big firms and that is as sure as tomorrow, then it is the death knell for the smaller firms as the playing field for them will not be level but tilted vertically upwards. Also notice statements from organisastions like the (private) International Bank Of Settlements instructing all banks to stay within certain criteria for stability purposes. What this is code for is selling off at rock bottom prices the assets they steal off failed businesses and pass them on to vulture type funds. Potential Cost of Covid-19 to the Tax PayerIf it is costing €200 million year a week or €0.8 bn every 4 weeks for the Covid payments or thereabouts, then you may as well round that up to €1.0 billion a month. From CSO data (ref 4) for 2018 government revenue from taxes and social contributions was €60 bn and €13 bn respectively for a total of 73 bn. Lets us assume 25% end up unemployed for 6 months, that works out at a 25% tax revenue reduction or (73*0.25*1/2) €9.1 bn. Add this to the 1.0 bn cost per month and you get 6 + 9.1 = € 15.1 bn. This does not include any other costs. You can now see how KBC very reasonably doubled these figures, and no doubt identified additional costs that the government is incurring and probably had estimated many will not get back to work immediately and so forth, to get their €30 bn cost. However this rough calculation is for 6 months, but what the Irish government and it seems many other governments, are doing is hanging on every word that comes out of the WHO. And each day the WHO recommendations are more extreme and desperate. They have only one agenda it seems and that is remain in lockdown and wait for the vaccine. If you wanted to crash the world economy, this is exactly how you would do it. If we follow their faulty corrupt advice, we should all stay at home for the rest of our lives in case the virus gets us. They seem to forget we are exposed to billions and trillions of virus every day, all of our lives, so far. How did we get this far? But clearly there is more to this. When and if this is all over they will say they made a "mistake". But it is no mistake. They are pushing their agenda really hard and the media are doing their level best to talk up the numbers and imply young people are dying when consistently when you read on practically all of those who die are very old with underlying conditions and most of the few younger (but really middle aged) people who die also have underlying conditions. They are trying exceedingly hard to scare the pants off us all and unfortunately succeeding. Therefore if this were to go on till the end of the the 2020, the conservative cost figure could head towards €100 bn because the damage will accumulate and unemployment will be higher and tax revenue far lower. What these costs do not account for is the unpredictable and that is the number of business that will fail. Nobody really knows that number but what we do know even if sanity returned in the morning is that the carnage will be huge. A great many pubs, cafes and restaurants, possibly hotels and thousands of numerous unheard of business will go bust and never re-open. Much of it will be due to cash flow problems. When you are so big, the banks don't and can't afford to let you go and generally some mechanism is found to keep you afloat. The bigger you are the more likely there is some kind of bailout paid by the taxpayer. Therefore there is one thing we can predict and that is tens of thousands of small business will fail and most of the big ones will be bailed out and or have enough resources to weather the storm and thus survive. In every single recession this is the general rule of thumb. What does this mean? Well we know that most of the GDP and wealth is owned by the much fewer but far bigger firms and the bigger ones will be in a position to swoop down vulture like and pick up all the valuable bits of the carnage left over. This will act to further concentrate wealth into the fewer large firms, the biggest of which are multi-nationals. The Vulture Funds are Coming for Your HouseTo pay for the damage, whether the final cost is €30bn, €60bn or €100+bn if we remain locked down even longer, we can expect to see an increase in taxes and a re-introduction of the full force of the Universal Social Charge (USC). As per usual the first cuts will be to social welfare, disabilities and all the people at the bottom and largely without say. Many are saying this will be worse than the 2008 crash which means the cuts can only be deeper. Whether this is the case or not remains to be seen. One certainty is that there will be another mortgage crisis. With hundreds of thousands unemployed and no way to keep up the payments we will be back to the mayhem. This time it will be different because now that the vulture funds have taken root here, the banks may well either on their own bat or under instruction from government, hand over all their bad loans to them. This will be presented as a way to solve the problem because the Vulture Funds may offer to step in and "save these people". It will probably be some crafty dishonest scheme where they take over the bad loans and since it is distressed you will be forced into some sort of deal where you have to rent off them for the next 20 years or something. The devil will be in the detail because it will be through the small print they will hoodwink people out of their homes. You can be sure they will have it legally watertight. The aftermath of Covid will offer the chance for vulture funds to feast on distressed property and steal a large chunk of it as just outlined. In many ways they will be like the virus itself and those financially weak will be a highest risk. It would of course be an excellent outcome for the vulture funds if this were to happen and from their perspective the lockdown must be great. The longer it lasts the greater amount they can steal later. If this pans out and there is no logical reason why it could not, we will have come full circle after a journey of a few hundred years back to where the country is owned by landlords. This time instead of being absentee English ones, they will be absentee corporate vulture funds. The future is so bright indeed. The government will of course be pressed on this and will no doubt on foot of legal advice state they are unable to intervene because it would interfere with existing legal obligations and incur potential liabilities. The Pension FundsThis is a good question. After the government raided the national pension fund last time, they never really put back the money. This leaves the private pensions or the money working people have saved in various schemes for their retirement. In the last round after 2008, most of these funds halved and took the next ten years to come back to approximately the value they were pre-crash. There will be plenty of workers who only started paying into a pension since 2008 and so will get to experience the medium term pump and dump cycles whereby the well connected elite encourage the middle class to pour money (.i.e their savings) into pensions or some form of institutional investments for relatively calm 10 years. Then there is the inevitable crash and they get cleaned out and it all starts over again. That pension funds will plummet is a safe bet. Only the depth, is the question. Perhaps some folks have been scared sufficiently by "The Bug" to not worry about it but it sill remains an open question of how deep the hole is. One should consider it as yet another cost incurred by many due to the lockdown. The sad fact is that there will be quite a few here where not only will have their pension destroyed but will be jobless and if luck is not going their way, be up to their neck in mortgage debt arrears. This is not the time to get depressed. It is time to wake up to what is going on, ask deep questions you have never asked and to not isolate yourself alone subjected to media lies but to overcome social taboos and discuss what is happening with your fellow frightened citizens and chart your own future together. If you buy into this pre-planned global fraud you will sorely regret because now is the time to act, not later when it is too late and your fate is sealed. The problem with a pension is that you need to be either paying into one for at least 30 to 40 years and therefore need to have a job of that duration or if you are in the position to do so, pile money in during the last 10 to 20 years of your working life and take advantage of the great tax breaks for it. Losing your job later in life affects that plan and so any discussion of the fate of pensions is linked not just to the loss of value of the funds themselves but to one's employment since that dictates how much money you can put into a pension. Already we have seen in early April, Debenhams retail chain have closed all their stores with immediate effect and 2,000 jobs lost. (Ref 5). The workers who tried protesting over the lack of any redundancy payment were moved off the streets and ordered to go home. The loss of these jobs illustrates the issues at hand. So consider this. If 500,000 are unemployed now when will they get jobs? What is happening to their existing pensions. Is there enough funds in them for their retirement. Answer: unlikely. And the fund value that is there is probably nose diving. Some of these workers had served 34 years. That means they must be in their mid 50s. What are their prospects now. Have they paid off their mortgages. Will they ever work again? The Wider International EconomyFor no better reason that the fact that airlines are the main way to leave Ireland, we will focus on them. First off if you ground a plane for a month or even far longer which looks to be the case, you can't just round up the crew and fill it up with fuel and passengers and fly off. The flight crew given the long lapse of time they have not being flying will need to brush up on training. Then there is the aircraft maintenance. They will need to go through a full system check. Think of all the lubricants for example that would slowly collect at the bottom of various machine parts and upper parts will have dried out. There will be thousands of other such technical matters. Then as everyone rushes to get this done, there will be a bottleneck because the system is not designed to do this all at once for every aircraft simultaneously. In air traffic control, I'd imagine things have been extremely quite. One would expect that the ramp up there would have to be managed carefully and slowly because it is such a tense, focused and critical job, the air-traffic controllers will need time to get used to and back to their hectic pace. Who then wants to step aboard the first plane brought back to service? [Update: Apparently Ryanair are doing short ghost flights every 4 days for each plane to keep them in working order. That is positive news.] For hotels many of which are basically either lying empty or running as a skeleton operation, there will be also sorts of maintenance and repairs needed which will have not been done because these service sectors have been in lockdown. The longer this lockdown goes on, the more costs will build up. Surely there are hotels, offices, whatever that have sprung leaks which would be normally promptly spotted and fixed, are now causing havoc and will do so much damage to buildings as to put smaller operators out of businesses. For the smaller operators and outfits like guest houses and there are 100,000s of these maybe millions all over Europe, the revenue you get in on a given season covers your costs to get to the next. If local councils and authorities are demanding their various charges and taxes despite them having no income, they're gone. Or they may have loans out on the properties or if that is not an issue, it may well be, ongoing maintenance is such a high cost annually that the lack of income will mean they are gone bust. We are beginning to see the effect of this because in all previous downturns tourism might have slowed and decreased quite a bit but never has the whole tourism industry itself completely stopped for months. The job losses in tourism have to be huge and won't be coming back soon. It could take years to recover if ever. This scenario has got to be playing out for tens of millions of small businesses throughout the locked-down world. The damage is incalculable. There is without a doubt a huge unemployment wave coming. The only way to get it all working again is through the lubricant of cash. Unfortunately the history of crashes, recessions and depressions, is that the biggest and wealthiest are first at the table and get the most favourable treatment. Usually after some period there is some level of normality but that tends to be from the hard graft of starting out fresh again from the smaller players and due to the fact since they are always more nimble and flexible, they manage to carve out a little space for themselves.. The companies that are doing well and continue to do so, are the giant corporations like all of the Big Tech and the likes of Amazon who will come out of this with even more people buying online who hadn't done so before. This will allow them to literally eat into the mainstream retail sector, everywhere. Purveyors of online working and communications will do well and Zoom Corporation is likely to be bought up by some giant for untold billions. All the big food retail industries are largely intact and the world's biggest, WalMart will be in a position to buy up whatever competitors it has left. For the suppliers of food -i.e. farmers they are likely to be squeezed further by the small number of big players who they sell to and which is really their only outlet. This will allow the big guys to grab the income of the small guys as they will be on their knees. This will be replicated all across sectors where these types of relationships occur and they occur everywhere. That's partially down to technological changes enabling this process and one of the not-so-cool sides of tech. National governments everywhere are going to be struggling with finances and having to cope with greatly increased debt burden. Everywhere taxes will go up and services will be cut back. With the Covid virus causing deep wounds in the economy and more damage than the disease itself, it will take a long time to recover because so many business will have disappeared that there will be just this large void where previously it was full of millions of small business employing millions of people. So here is the scenario for the middle and lower classes. (Technically both of these compose the working class in an economic sense since you are defined as working class if you earn most of your income by selling your time and or skill. This takes in nearly all of the middle class and the so called working class in it's social context but are really lower class in economic terms. Middle class people never refer to themselves as working class but they are by virtue of the criteria just outlined.) Huge numbers will remain unemployed. Those with incomes will face big increases in taxation on the one hand and face pay cuts on the other. Some of these people will be in mortgage and or rent arrears while those unemployed will definitely be in arrears. In this environment, the chances of anyone taking annual holidays abroad or somewhere nice at home will be fairly slim. Therefore prospects for the tourism industry will be dismal with consequent knock on effects in that sector in terms of recovery. This will also affect the airline industry. There will be a battle by many sectors to recoup their losses counter weighted by the loss of demand. Typically the insurance industry will raise rates and are far more likely to drive more businesses to the wall. They were already doing this just before the crisis. Sometimes you have to wonder are they the secret weapon of bigger businesses as a way to crush smaller ones through insurance premium costs and keep the competition out. For other sectors the inevitable reduction in demand and loss of buying power by the public means usually means closures and consolidation in those areas. Prior to internet and the widespread use of online shopping, if there was a big downturn in some sector, generally it would come back usually in the form of lots of small startups. This time around the recovery will be different because the likes of Amazon and other Big Tech firms will be able to rapidly ramp up and serve those areas where demand may slowly return. This in some ways prevents a recovery for many small businesses because the big players will hold that space. This in itself, by slowing the recovery, affects future job recovery. The Effect of Increase in the Concentration of Global Wealth and Final SolutionGlobal wealth is already highly concentrated as are all of the various industries. In all cases a few large firms dominate for the biggest slice of the pie and the myriad of others nibble on the bits left over after you subtract the total share of say the top 3, 4 or 5 players. The small players -i.e. the small business though are key to the survival of the big firms in an indirect way because proportionally the bigger corporations employ fewer people which can be used to argue they are more efficient at bringing goods and services to millions of people, while the small businesses by far employ the most people. The income they earn gives enough people money to buy stuff off the bigger firms to keep going. The structural repercussions on the economy due to the internet and online shopping before the crisis was already upsetting this dynamic. The aftermath could easily accelerate that evolution. This raises a question then and that is surely for a given industry or sector there is a point where if the top 2 or 3 firms are taking all the businesses or revenue available, it crushes all the smaller players. For example in Ireland the beef industry is dominated by one big processor. There is hardly any competition. The effect of this is that the are very few other processors and they are tiny anyhow and consequently this puts the sellers -i.e. farmers at the mercy of the single processor and they are treated accordingly. If you can wipe out all the competition in your area, that is great for you and tough for everyone else. So far we are only talking about a single sector. If we examine the total global wealth we know there is a huge concentration of power. The annual Oxfam report says 62 people own half the worlds wealth. Their tentacles spread far and wide and they would have all sorts of holding companies owning shares in thousands of different global and national firms and their representatives acting on their behalf on the boards of all the firms down their chain of ownership. When the approximately 7,000 billionaires are added the share of this tiny group of the global wealth must be far higher. The same dynamic applies here as described for a single dominant firm with no competitors in a given sector. If the these people own so much wealth and earn vast fortunes each year and the remaining bulk of the population in the world are barely getting by on their low wages and it has progressed to such a state where many (younger) people have no prospect of ever owning their house, are locked into exorbitant rents and chronic debt, this would suggest many of the middle class who thought they were a cut above the rest, are on a downward trajectory. The key problem for the top 7,000 billionaires is as they take more and more of the wealth produced by everyone else, the masses will soon not be able to buy the goods and services which the elite own and sell to them. There is a risk of collapse of purchasing power as it were and that threatens the whole system. ...the Covid payments given by most lockdown countries is just this universal basic income under a different name... The members of the 7,000 club are generally quite bright people and they have access to the brightest minds and the greatest resources by virtue of their position. Some may have noticed in the last few years discussion in the media about the concept of universal basic income for everyone; see ref 7. The idea is that governments would pay everyone regardless of who they were a basic income to allow them to exist. Anything extra you earn, you keep. At the moment, the Covid payments given by most lockdown countries is just this universal basic income under a different name. The Covid payment -i.e basic income is just the ticket to keep the system going for the 7,000 club and it can't have failed people, to notice it is all the smaller firms that are getting badly hurt in this crisis and most of them could well cease to exist afterwards. The metric is quite simple. Lockdown for 3 months a certain fraction will go bust. Lockdown for 6 months, 9 months or till 2020 as the WHO suggests and I think it is obvious that perhaps the great majority of small firms everywhere, will be gone possibly to never come back. When you are a member of that special 7,000 club you must get bored with money after awhile and the temptations of the power you have must be more alluring and exciting. Every year the concentration of wealth increases and intensifies. Some people question why these people want so much money but the fact is they do because a smaller fraction have more and more each year. This can only continue perhaps to it's logical point. This point is not really when one person owns it all, the point in fact is when the system has gone through such changes because of the concentration of wealth and thereby power because one controls all the resources, that structurally it has transformed dramatically under the weight of it's own internal forces. We might be seeing the caterpillar to butterfly type of metamorphosis in the global (so called) capitalist system except it may not be so pretty. Here is another point to take on. If you own your house and are cash rich and all your neighbours are cash poor and have mortgages and they all go bust then you can probably buy all their houses and rent them back to them, indefinitely. The sort of thing ambitious, ruthless people might do and the trait you need to reach the top. For the 7,000 club if you own most of the worlds wealth and the world's economy happens to completely crash then that's not so bad since you own it. The beauty is that you can buy up all the remaining good stuff. You now will have received a huge jolt in wealth while everyone else is impoverished. You definitely need to make sure they get the basic income. There is just one problem though, you don't want to pay them too much, certainly not enough to go on holidays, fly abroad, eat out regularly, buy furniture, stay in a hotel. In this new economy there would there would be little need for these things and a great portion of the worlds fleet of passenger aircraft could be mothballed. Besides if there is going to be very little demand, it will cost too much to bring a lot of these planes back into service. Luckily for the billionaires they have their own private jets. I hear people say why would they destroy the tourism sector. Well prior to Covid, the millions on pitiful wages were struggling to exist and it is highly unlikely they ever went anywhere fancy. It just that the great bulk of the middle class will be lowered down to this level. If this transformational switch is made globally, its really all about power at that point and your comforts will not feature in the plan. This automatically leads to question. Where is the money coming from and whose money is it anyhow? What is money after-all and even what is wealth? Money is just credit on bits of paper. Despite what people think, it is not backed by gold. That link was severed many decades ago. The 7,000 club contains all the bankers, so it is quite likely between themselves they will come to some arrangement between themselves. National governments have given away most of their control to 'independent' central banks which really are private; run by unelected, unaccountable individuals so there is little chance of interference by them. Besides through ownership of the media and internet, they essentially can control any government and use Epstein like people to take down anyone powerful enough to make noises. To conclude the strange thing is that if you wanted to crash the world economy and bring forth this scenario outlined, then you would do what the WHO are calling for. Keep the global economy locked down for the rest of the year and even until 2022. The other sinister message in this crisis we keep hearing is that there will be a second and even third wave of the virus each more deadly than the previous. You can't have failed to not heard this. They say this confidently too which is actually the scarier part. Who knows what the vaccine will really contain but you have to ask yourself why is it being pushed so strongly. Surely tne sensible too to do is to promote basic health and ways to build up and strengthen your immune system of which there are many. People really don't understand anything about vaccines, but they can be contaminated and they can be doctored to put a pun on it, to contain literally anything. Take note of this:

If a vaccine can be implanted with a sterilization agent, any other health or DNA affecting molecule or protein can be put into a vaccination cocktail. See ref 8 links to these stories of Kenya: Thousands infertile after govt-sponsored vaccination and “Mass Sterilization”: Kenyan Doctors Find Anti-fertility Agent in UN Tetanus Vaccine? ConclusionWe started out trying to figure out what the devastation would be like after Covid-19 but once you look at the figures, take in the scope of the problem and note a few other worldly key facts and figures it is almost impossible to come to any other conclusion other than the whole thing smells of a rat and what we have in play is a global transformative change under way with the "Bug" used as the initiator of events. To put it more militaristic terms you could call it a pre-emptive strike. The script has still some way to go because they did promise a second and even third virus and it would be far more deadlier. So for those who don't accept this conclusion, I can only assume then that they must accept everything the media is telling them and here is the puzzle. So if several more deadly waves are coming and the economy is going to be pretty wreaked as it is, what is it going to be like after the 2nd and 3rd wave which could last for years? Ah but they are just trying to save lives. Really? And are you quite happy to sheepishly accept everything and see your entire life turned upside down, civil liberties slashed and being ordered into lockdowns ona whim. What we have at present is not life. It's existence. The goverements are treating us like small bold children. It is time people got a backbone, started thinking for themselves and stand up for whats right and being an active participant. So far we have shown ourselves to be more docile than sheep. Already the Swedes who have had no lockdown are being to mock us. This present lockdown could simply be the first stage in the transformation. If the lockdown was lifted tomorrow frozen markets would resume and this would allow the billionaire class to formerly buy up all the distressed assets. Yet the population will now be fully conditioned to the new norms of wearing masks, isolating from everyone, thereby minimizing the risk of a counter reaction as real face to face discussion is largely eliminated and they would remain fearful and suspicious of each other. Critical thinking is already a distant memory and would remain so. The very top layer of the capitalist elite would know exactly for the next round what works and what are the weak points and the media matrix would be further tuned for maximum effect. Then when the second wave's arrival is announced, lockdown could be in place within hours as the Pavlovian like behaviour indoctrinated successfully in the past few weeks in the population would ensure immediate acquiescence. Given destruction of peoples livelihoods, businesses, jobs, civil liberties and social norms barely raised a flutter of suspicion in the first round, then it is unlikely to raise suspicions in the second either and this can only increase the dis-regard and contempt for our lives that the elite have for us. In some ways this is symbolized by the instruction to not allow proper funerals / rite of passage -something every civilisation, society, culture and religion has held as a core value and yet on this too we have willingly accepted submissively. References: Ref 1: Foregin Multi-Nationals in Ireland https://www.cso.ie/en/releasesandpublications/ep/p-bii/businessinireland2017/multinationalsanirishperspective/ Ref 2: https://www.thebalance.com/the-u-s-debt-and-how-it-got-so-big-3305778 http://www.shadowstats.com/ https://en.wikipedia.org/wiki/List_of_countries_by_external_debt Ref 3 Government's Covid-19 costs could hit €30 billion - KBC https://www.rte.ie/news/business/2020/0401/1127866-governments-covid-19-costs-could-hit-30-billion-kbc/ Ref 4 Government Revenue for 2019 https://www.cso.ie/en/releasesandpublications/er/giea/governmentincomeandexpenditurejuly2019/ Ref 5 Apr 9th: Debenhams to shut all stores in Republic with loss of 2,000 jobs https://www.irishtimes.com/business/retail-and-services/debenhams-to-shut-all-stores-in-republic-with-loss-of-2-000-jobs-1.4225143 Ref 6: 62 people own the same as half the world, reveals Oxfam Davos report https://www.oxfam.org/en/press-releases/62-people-own-same-half-world-reveals-oxfam-davos-report Ref 7: Why we should all have a basic income https://www.weforum.org/agenda/2017/01/why-we-should-all-have-a-basic-income Ref 8: “Mass Sterilization”: Kenyan Doctors Find Anti-fertility Agent in UN Tetanus Vaccine? https://www.globalresearch.ca/mass-sterilization-kenyan-doctors-find-anti-fertility-agent-un-tetanus-vaccine-2/5678295 Thousands of teenage girls report feeling seriously ill after routine school cancer vaccination https://www.independent.co.uk/life-style/health-and-families/thousands-of-teenage-girls-report-feeling-seriously-ill-after-routine-school-cancer-vaccination-10286876.html Additional References Forbes 2020 World's Billionaires (4MB) https://cryptome.org/2020/05/forbes-2020-billionaires.pdf

by T by T Fri May 29, 2020 21:28 Fri May 29, 2020 21:28   First the bad news from this report  by anon by anon Sun May 10, 2020 12:51 Sun May 10, 2020 12:51

|

printable version

printable version

Digg this

Digg this del.icio.us

del.icio.us Furl

Furl Reddit

Reddit Technorati

Technorati Facebook

Facebook Gab

Gab Twitter

Twitter

View Comments Titles Only

save preference

Comments (5 of 5)

Jump To Comment: 5 4 3 2 1https://www.irishtimes.com/news/social-affairs/many-pubs-will-never-reopen-after-curbs-lifted-auctioneer-says-1.4510070?mode=amp

Vintners representatives say they are expecting many of Ireland’s 7,100 pubs to remain shut once restrictions are eased and Covid financial supports are halted.

On March 15th, 2020, the Government requested the closure of pubs in the State – which employ about 50,000 people – for two weeks as a result of Covid-19. Many have not reopened since.

For many years numerous financial commentators had been talking about the pending disruption of the financial system when the US dollar looses its world reserve currency status. Alongside this were many reports that not only would the gap be replaced by a gold back standard but that the gold prices had been suppressed by the US for years in order to hold off that day and that since the early 2000s both China and Russia had been buying gold in anticipation of that event.

Now the World Economic Forum composed of the financial elite and the same people who brought us endless wars are talking about the "Great Reset" and they are holding a conference on that very subject in the next few months.

So it is with interest, that one person actually spelt that out and that was a Dutch man called Willem Middelkoop who first published a book called: The Big Reset with subtitle War on Gold and the Financial Endgame in 2013 and which became a best seller. This likely means that all the insiders are aware of what is now happening and have already protected themselves.

What this means is there is a high likelihood the rest of us are going to get fleeced which basically means the investments backing pensions will plument in value and there will be a huge drop in living standards and "wealth" of a broad section of the population.

Here is the blurb for the revised edition from 2015 because it is instructive when you consider events today.

Evidence of financial problems

If you wanted proof that this whole Covid pandemic hoax was designed to eliminate the tourism industry, a UN report which advises that up to 120 millions jobs in the sector are at risk world wide proves the point along with losses of up to $1.2 trillion (or 1,200 billion !)

This was reported by rt.com here: https://www.rt.com/business/499172-covid-losses-tourism-un/

The report from the United Nations is reported on the UN website here: https://www.un.org/en/coronavirus/it-imperative-we-rebuild-tourism-sector

And the report itself here: https://www.un.org/sites/un2.un.org/files/sg_policy_brief_covid-19_tourism_august_2020.pdf

One quote from it is: